One big talking point of the property seminar I held at the start of this month was the affordability of property in Chichester.

Whilst

property values in Chichester have only increased 1.7% in the last year, in the

past decade prices are up by nearly a quarter!

At

the same time interest rates have plummeted, so whilst renting used to be on a

par in terms of cost compared to owning your own home, now it has become

incredibly cheap to finance a property purchase.

Most

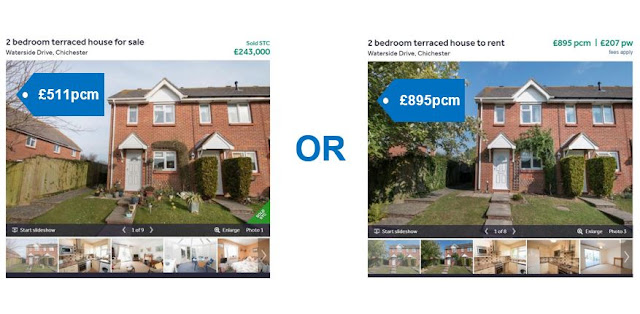

recently a very pleasant two-bedroom house in Donnington was for sale at

£243,000; a perfect first-time buyer starter home.

If

we assume it sold for £240,000, our first-time buyer would require a £12,000

deposit, £2,300 stamp duty plus money for the legal fees. Their £228,000 95%

mortgage with a five year fixed rate of 2.69% would cost £511 per month (which

includes paying down the debt).

That

same house was in fact sold to a buy-to-let investor and is now up for

rent…..at £895pcm!

So,

if it’s so much cheaper to buy why doesn’t everyone do so?

Well

there’s certainly some who choose to rent rather than buy for social and job

mobility reasons. Some don’t want to be tied down to a particular property or

area and in today’s more nimble economy this can be a sensible practice for

many.

But

affordability issues remain a major factor; with difficulties in raising the

deposit as well as getting the banks to lend enough money in the first place.

A

couple with a joint income of £50,000 are likely to be able to borrow around

£200,000 from a bank……not enough to buy the two bedroom house I mentioned

earlier without having an extra £40,000 to spare.

Consider

that same couple earning £50,000 could theoretically RENT a property up to

£1,650 per month (based on affordability criteria set by referencing agents) and

you can see why some are choosing to rent a nicer property than they could

‘afford’ to buy (they could afford to buy it, they’re just not given the chance

to).

This,

for me, is the major issue facing our property market - banks’ unwillingness to

lend at what are seen today as abnormal interest rates. Whilst for the next

five years it is evident that buying the same property is far cheaper than

renting, banks still assume interest rates will be at a more ‘normal’ level

after this period and thus loading up on debt now would be unsustainable in the

long run.

Taking

a step back, I feel this is the number one factor in terms of future house

prices. If today’s low interest rates become ‘normal’ then property prices will

surely surge as lending becomes more available. If, on the other hand, interest

rates revert to pre credit crunch levels then prices are likely to flat line….and

if we see interest rates of 15% like we did on Black Wednesday in 1992 then all

bets are off!

(This article was featured in the Chichester Observer's property section on 15th September 2016)

Clive Janes, CRJ Lettings.

www.crjlettings.co.uk

___________________________________

If you are looking for an agent that is well-established, professional and communicative in Chichester, then contact us to find out how we can get the best out of your investment property.

E-mail me on clive@crjlettings.co.uk or call 01243 624 599.

Don't forget to visit the links below to view my previous buy-to-let deals and Chichester Property News articles:

Follow The Buy-To-Let Property Investment Market in Chichester

Chichester Property Market LinkedIn Page for Clive Janes

CRJ Letting Agents Chichester Facebook Page

CRJ Letting Agents Chichester Twitter Page

Chichester Investment Property Management Specialist CRJ Letting Agents Website

Chichester Property Market LinkedIn Page for Clive Janes

CRJ Letting Agents Chichester Facebook Page

CRJ Letting Agents Chichester Twitter Page

Chichester Investment Property Management Specialist CRJ Letting Agents Website

c/o CRJ Lettings, 30B Southgate, Chichester, West Sussex, PO19 1DP

__________________________________

No comments:

Post a Comment