A lot

has happened to the political hierarchy in the four months since the shock

result to leave the EU. Meanwhile, the pre-referendum predictions if we voted

out have largely been unfounded. An initial plunge in the stock market has since

reversed to all-time highs whilst interest rates, which were predicted to rise,

have dropped to all-time lows!

In

terms of the property market, before the election the general consensus was that

a result to leave the EU would bring house prices and rents down, making them

affordable for the masses once again (have they ever been ‘affordable’ in this

country?!).

George

Osborne warned of house price falls of 18% if we voted to leave. With an average

house price of £361,999 in Chichester, that would mean a drop in value of

£65,160 per property!

In

the month after the referendum result, house prices actually increased 0.4%

across the UK to stand 8.3% higher than a year ago. No obvious signs of panic

there then. Chichester fared even better with a rise of 2.7% in July (+7.2% in

the year).

You

could argue that with the pound dropping 16% against the dollar, our homes are

indeed now worth that much less than before the referendum. But, since we get

paid in pounds and pay our mortgages and rents in pounds, this has little

immediate impact on our finances.

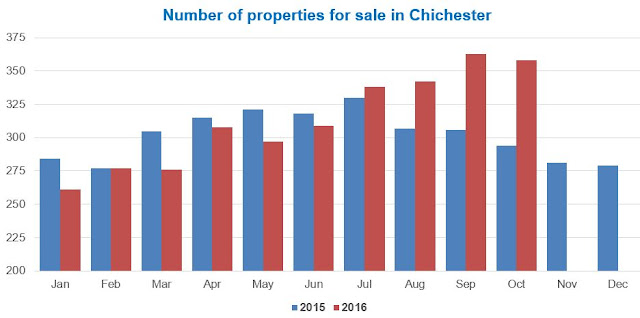

What

is more telling is that there was a 5.5% drop in the number of properties for

sale in Chichester between March and June compared to the year before, as the

uncertainty in the lead-up to the referendum made homeowners wait to see what

happened.

Immediately

after the result to leave however, the number of properties on the market shot

up; in fact there was a 13.3% increase between July and October compared to a

year ago.

So, are

people rushing to the exits before the predicted house price falls? Or is this

just pent up demand from those fed up of waiting for events that are out of

their control?

Whilst

the unexpected referendum result has created some uncertainty in the housing

market, I’d say there is no need to panic. Common sense should prevail as

people realise that property is a long-term pursuit; bear in mind that prices

have risen nearly 2,000% in Chichester since the previous EU referendum in

1975! Having survived the credit crunch, Black Monday and 15% interest rates

during that time, I think Chichester’s house prices will fare just fine as we

navigate through Brexit.

(This article was featured in the Chichester Observer's property section on 20th October 2016)

Clive Janes, CRJ Lettings.

www.crjlettings.co.uk

___________________________________

If you are looking for an agent that is well-established, professional and communicative in Chichester, then contact us to find out how we can get the best out of your investment property.

E-mail me on clive@crjlettings.co.uk or call 01243 624 599.

Don't forget to visit the links below to view my previous buy-to-let deals and Chichester Property News articles:

Follow The Buy-To-Let Property Investment Market in Chichester

Chichester Property Market LinkedIn Page for Clive Janes

CRJ Letting Agents Chichester Facebook Page

CRJ Letting Agents Chichester Twitter Page

Chichester Investment Property Management Specialist CRJ Letting Agents Website

Chichester Property Market LinkedIn Page for Clive Janes

CRJ Letting Agents Chichester Facebook Page

CRJ Letting Agents Chichester Twitter Page

Chichester Investment Property Management Specialist CRJ Letting Agents Website

c/o CRJ Lettings, 30B Southgate, Chichester, West Sussex, PO19 1DP

__________________________________

No comments:

Post a Comment