The 2020/21 tax year is underway and with it comes the culmination of the mortgage tax relief changes affecting landlords. First announced during the 2015 summer budget, landlords have now lost the right to deduct their mortgage interest costs from their rental income, receiving a 20% ‘tax credit’ instead.

The 2020/21 tax year is underway and with it comes the culmination of the mortgage tax relief changes affecting landlords. First announced during the 2015 summer budget, landlords have now lost the right to deduct their mortgage interest costs from their rental income, receiving a 20% ‘tax credit’ instead.Whilst fans of the scheme suggest this won’t affect basic tax-rate payers as a result (the 20% tax credit matching the amount that would previously have been offset), the fact is the new rules will artificially increase a landlords ‘taxable income’ figure, which will push the majority into the higher tax-bands as a result.

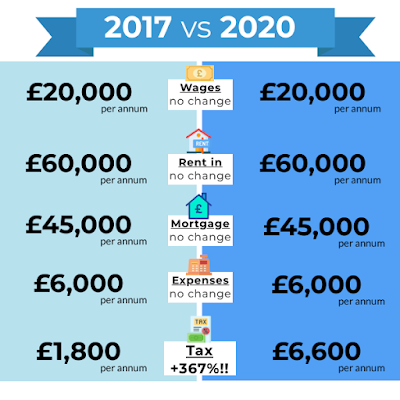

Consider Jeff, who is self-employed and earns £20,000 per year. He also inherited five rental properties, which now act as his pension. He receives £60,000 a year in rent, meanwhile his mortgage costs are £45,000 a year and other property expenses come to £6,000. Whilst this means he makes a modest £9,000 a year from his rental properties, he thinks that’s ok as he’s ‘investing for the future’. He considers his total income to be £29,000 and should therefore be taxed accordingly.

Indeed, that’s what the taxman used to think too, with Jeff paying £1,800 income tax on his £9,000 rental profits (an effective rate of 20%). Now however, the taxman regards Jeff’s ‘taxable income’ as £74,000, meaning a bulk of his rent gets taxed at higher rates, with only 20% of the £45,000 mortgage costs being returned as a ‘tax credit’. This results in a tax bill of £6,600 from the same financial figures; an effective rate on his profit of 73%! Worse still, his newly enhanced ‘income’ figure makes him completely ineligible for child benefits, whilst the student loan office will up his loan repayments just for good measure too.

Meanwhile landlords without buy-to-let mortgages won’t be affected by the changes and nor will large corporations. This has led many to complain that the wealthy are unaffected by the changes, whilst the already squeezed middle are having their purses raided both unexpectedly and unfairly (note how all other businesses can offset their finance costs in full before paying tax).

This is why many landlords are now purchasing properties via a company structure to avoid the new tax system. But this doesn’t help existing landlords, as transferring properties they already own to a limited company will typically incur capital gains tax and stamp duty as HMRC deems it to be a ‘sale’ to the company. The same issues apply if trying to transfer property to a spouse or partner who is in a lower tax-band.

Some landlords have exited the market as a result of the above, having calculated that buy-to-let just isn’t worthwhile for them anymore. This will lead to fewer rental properties being available, for which supply and demand suggests prices (i.e. rents) will rise as a result.

If you’re a landlord and would like me to review the health of your rental portfolio, please call me for a free chat to see how you might be affected by the changes.

This article was featured in...

If you are looking for an agent that is well established, professional and communicative in Chichester, then contact us to find out how we can get the best out of your investment property.

E-mail me on clive@crjlettings.co.uk or call 01243 624 599.

Don't forget to visit the links below to view my previous buy-to-let deals and Chichester Property News articles:

c/o CRJ Lettings, 30B Southgate, Chichester, West Sussex, PO19 1DP

E-mail me on clive@crjlettings.co.uk or call 01243 624 599.

Don't forget to visit the links below to view my previous buy-to-let deals and Chichester Property News articles:

- Follow The Buy-To-Let Property Investment Market in Chichester

- Chichester Property Market LinkedIn Page for Clive Janes

- CRJ Letting Agents Chichester Facebook Page

- CRJ Letting Agents Chichester Twitter Page

- Chichester Investment Property Management Specialist CRJ Letting Agents Website

c/o CRJ Lettings, 30B Southgate, Chichester, West Sussex, PO19 1DP

No comments:

Post a Comment