.png)

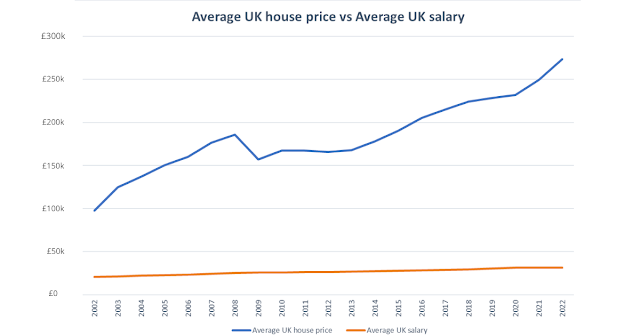

That means whereas it would have taken the average earner in 2002 a little under five years to afford to buy the average home (ignoring taxation), it would now take nearer nine years to do so. Plus, the deposit required has increased too, so that the fairly standard 10% deposit required has almost tripled from £9,762 in 2002 to £27,376 today.

It’s interesting to note that salaries have been fairly steady in their rise, compared to the sharper fluctuations of house prices. Only once did average salaries not increase compared to the year before, whereas house prices saw that happen for several years during the ‘credit crunch’. That one time drop in salaries (of 0.6%) came in 2020, which was almost certainly due to covid stymieing incomes. Their biggest annual increase (4.7%) came in 2007, just before the credit crunch hit. In comparison, the annual change in house prices has been far less predictable, ranging from a drop of 15.4% (in 2008) to an increase of 27.9% (in 2002).

The past decade has been a little steadier for house prices than the first decade of the millennium though; with their year-on-year change ranging from an increase of just 1.1% (in 2012) to 9.6% (in 2021). Notably, prices have ramped up in the past couple of years, with 2021’s gain having followed a 7.7% increase in 2020. That’s despite doom-mongers predicting a crash when Covid’s first lockdown was announced two years ago, with many would-be buyers even pulling out of purchases as a result. Since then, house prices have risen 18%, whereas incomes are still slightly below where they were when Covid struck.

The sudden jump in house prices these past two years, against a background of static incomes and other fast-rising costs (think energy and petrol prices), is why many are feeling the strain in their personal finances. Consider as well that our pound sterling has been decreasing in value against many other currencies, meaning our buying power is even weaker on a global basis. It is also why a lot of foreign money has come to the UK to sniff out property bargains (in their currency at least), making it even tougher for local workers to be able to afford local homes.

No comments:

Post a Comment