With all the headlines about house prices being out of control as they continue to increase to ever higher record highs, you may think I’ve gone a little mad to even suggest property prices in the UK today are lower than they were 15 years ago (when the credit crunch kicked off in mid-2007).

Well, it is in fact true….sort of….

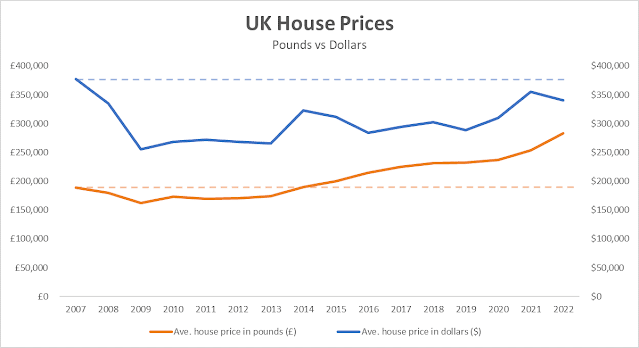

The average UK house price today according to Land Registry data is £283,496. This is indeed some 50% higher than the £188,691 the average UK home was worth in July 2007. However, that is when measuring it in Great British Pounds. Whilst that is certainly the logical thing to do when that is the currency we get paid in and use to pay our mortgages, it doesn’t tell the whole story.

Digging a little deeper shows that house prices have not risen at all….our ‘Great’ British Pound has merely become worth less….a lot less in fact when compared to the US Dollar - the ‘reserve’ currency that is widely used as the benchmark for trade around the world.

You see, in July 2007 when us Brits were paying £188,691 for the average home, we were also able to jet off to the US and exchange one of our pound coins for two US Dollars. That means we were effectively paying $377,382 for that ‘average’ UK home. As anyone who is currently wanting to exchange their pounds for dollars knows, you’ll get far fewer of them now when handing over the same amount of your hard earnt Sterling…with each pound currently being worth just 1.20 dollars. That means the current average UK property (costing £283,496) is actually worth just $340,195….11% less than 15 years ago.

Using the same formulae, the housing crisis in the US appears to be far more extreme than in the UK. The average US property currently costs $381,750, which is a 75% increase compared to their $217,839 peak in June 2007. Already then, our American cousins have seen prices rise far more in their native currency than we have in ours. But it gets worse for them when you consider the strength of the US Dollar.

Had you emigrated to the US in the middle of 2007 you would have needed £108,920 to buy the average US home (for $217,839). If you now chose to come back to Britain, you could sell your average US home (for $381,750) and convert the sale proceeds back into £318,125….192% more than you started with 15 years ago!

It’s also interesting to look at median salaries both here in the UK and over the pond. Whilst the media shares stories of strikes and people bemoaning pay not keeping up with inflation (especially when it comes to house prices), between 2007 and now the UK median salary has increased by 30% (£24,043 in 2007 to £31,285 now). In the US that figure is a mere 13% ($59,534 in 2007 to $67,521 now). Of course, you now know that’s not the whole story as our pay in dollars has effectively dropped by 22%, whilst the American worker’s median pay has increased by 89% in pounds!

Coming back to the earlier point I made though; it is logical to simply focus on the currency we get paid in and use to pay for our housing. On that score this all adds up to the UK having seen house prices increase 50% since 2007, whilst wages have only increased by 30%. Clearly that’s not a good place to be, but it beats our American friends who have seen house prices increase 75% in the same timeframe, compared to receiving just a 13% rise in their incomes.

Even so, when it comes to affordability, property simply remains expensive in the UK for us Brits - the average home costing 9 times our median salary, whereas in the US, despite a sharper increase in house prices and a slower rise in salaries, they still ‘only’ require 5.7 times the median annual income to afford the average home.

Whilst you may think much of this is irrelevant, the fact is that the world is more inter-connected than ever before, so currency fluctuations distort our wealth on a global scale. We have largely been on the wrong side of this trade for the past 15 years, which is why we have seen a growing number of foreign individuals and companies purchasing property in the UK as it has become ‘cheaper’ in their native currencies.

No comments:

Post a Comment